There is a lot of news as we enter the time for payments re-starting after the pandemic pause. You may need to take action to get the most benefit: possibly consolidating loans before December 31, 2023 for the one-time payment count adjustment for income-driven repayment plan debt forgiveness and Public service Loan forgiveness. And for loans in default, you need to sign up for Fresh Start to have your debt shown as “current” and have access to benefits such as enrolling in an income-driven repayment plan that could give you payments you can afford.

Keep reading, or watch the recording from my presentation for the Elk Grove Public Library from September 7, 2023.

One-time Payment Count Adjustment: Student loan borrowers who are in an income-driven repayment plan or in the Public Service Loan Forgiveness program, may have additional months of payments counted toward those forgiveness requirements, starting in July 2023. The announcement may also affect those who are are interested in an income-driven plan and have either Direct or Federal Family Education Loans held by the US Department of Education. Some borrowers have already been notified that their remaining loan balance has been forgiven. Others will be notified between July and the end of 2023. These corrections are being done to address past inaccuracies and other problems with the administration of these loan forgiveness programs. See https://studentaid.gov/announcements-events/idr-account-adjustment and https://www.ed.gov/news/press-releases/department-education-announces-actions-fix-longstanding-failures-student-loan-programs. Important: You have until the end of 2023 to consolidate loans that don’t qualify for these forgiveness plans and not lose credit for the payments you have already made.

SAVE: A new income-driven repayment plan called SAVE will offer significantly lower payments for many borrowers. It will replace the REPAYE plan, but you can switch from other plans, too. Some aspects of the new plan were already effective July 1, 2023, and additional ones will begin in 2024. For more information, see https://studentaid.gov/announcements-events/save-plan and https://www2.ed.gov/policy/highered/reg/hearulemaking/2021/idrfactsheetfinal.pdf.

Fresh Start: Loans that are in default can get a Fresh Start until September 2024. One of the most important benefits is access to income-driven repayment plans, which could give you manageable payments and get you on track to loan forgiveness.

Prepare to Restart Payments: Interest began to accumulate Sept. 1, 2023. Payments will re-start in October. If you haven’t already, verify that your contact information is correct on loan servicer’s website and in your StudentAid.gov profile. Compare repayment plans with Loan Simulator. The new SAVE plan could save you money. Find out by using the loan simulator at https://studentaid.gov/loan-simulator/

General resources

These are your “go-to” sources for information about student loans. Use the search tools to find answers to your questions.

- https://studentaid.gov/h/manage-loans to find answers to almost anything related to Federal student loans.

- https://studentaid.gov/announcements-events/coronavirus for questions about the payment suspension during the coronavirus pandemic.

- http://studentaid.gov/login to take action on your loans, such as consolidating, applying for an income-driven repayment plan, or locating forms.

SUSPENSION OF LOANS DURING THE PANDEMIC

Suspended payments count as on-time payments for:

- Reporting to credit reporting agencies. Check your credit reports at annualcreditreport.com to verify they have been reported correctly.

- 120 payments toward Public Service Loan Forgiveness

- 20/25 years of payments to complete income-driven repayment plans and forgiveness of the balance.

- Curing a default.

What happens when suspension ends?

- Your first payment will be due starting in October 2023.

- Interest will begin to accumulate again starting on Sept. 1, 2023.

- Collections may begin.

- Recertifications for income-driven loan payment calculations will be required beginning in Marsh 2024. If your income dropped during the pandemic or your family size increased, you can voluntarily recertify.

Prepare to Resume Payments

StudentAid.gov suggests the following steps to prepare for payments to resume. Go to https://studentaid.gov/announcements-events/coronavirus for details and links.

- Update your contact information in your profile on your loan servicer’s website and in your StudentAid.gov profile.

- Check out https://studentaid.gov/loan-simulator/ to find a repayment plan that meets your needs and goals or to decide whether to consolidate.

- Consider applying for an income-driven repayment (IDR) plan. An IDR plan can make your payments more affordable, depending on your income and family size.

- Check whether you are (still) set up for auto-debit payments.

- Contact your loan servicer to ask what your payment amount will be.

- Watch for your billing statement or notice. You should receive it at least 21 days before the due date.

PUBLIC SERVICE LOAN FORGIVENESS

To qualify for Public Service Loan Forgiveness, you must make 120 payments. They do not have to be consecutive, but they must have been made after Oct. 1, 2007 when the program was first put in place. The forgiven amount is NOT taxable

For each payment to count, you must:

- Have qualifying employment.

- Make the payment on a qualifying type of loan(s). However, you have until the end of 2023 to consolidate loans that don’t normally qualify for these forgiveness plans and not lose credit for the payments you have already made. See One-time Payment Count Adjustment at the top of this page.

- Be in a qualifying repayment plan.

Qualifying employment means:

- Working for a qualifying employer

- Government – any level, entity

- 501(c)3 nonprofit

- Some other nonprofits

- AmeriCorps and Peace Corps volunteer

- Check the database of qualifying employers at https://studentaid.gov/pslf/employer-search/search-tool. You will need the EIN (employer identification number) which will be on your W-2.

- Full time – at least 30 hrs/week

- Part-time totaling 30 hrs with 2 qualifying employers will count

- Employed with a qualifying employer:

- At time of each payment

- When apply for forgiveness

- When the loan is forgiven

WHAT TYPES OF LOANS DO I HAVE

- All of your Federal loans – except for PLUS loans in the parent’s name – will be listed in your account at StudentAid.gov/login.

- Enter your username and password and select LOG IN if you already have an FSA ID. If you do not have an FSA ID, select the Create An FSA ID tab.

- Go to the aid summary section. Scroll down to the Loan Breakdown section. For each loan, you will see the type of loan, the amount, the date of the loan, how much money you received, how much of that amount is still owed, and any unpaid (outstanding) interest. Click on the # by each loan to see additional details, including the name and contact information for your loan servicer and lender, and the current and previous statuses of your loan

- If additional loans appear on your credit report, those will be private loans. Check your report from all three major credit reporting agencies at annualcreditreport.com/

Private Loans

- Managing private loans during repayment: https://www.thebalance.com/managing-private-student-loans-316296 (note: this site contains ads, but they claim that their information is unbiased)

Perkins Loans

COMPARING REPAYMENT PLANS

- For an overview of the various repayment plans, go to https://studentaid.gov/sa/repay-loans/understand/plans

- Use the Loan Simulator to compare the monthly payments & interest you will pay for each plan at https://studentaid.gov/loan-simulator/.

- Log in with your FSA info to use actual loan info or click Proceed to enter loan info manually or use national averages.

- Click each loan to see the plans for which it qualifies. Switch the loan type to “Consolidated” to see if that gives you more options.

- This page is designed for borrowers who have not yet made payments on their loans. If you are already making payments on your loans, your loan servicer should be able to give you more correct, current information about your options.

- Get detailed information and read FAQs about income-driven repayment plans at

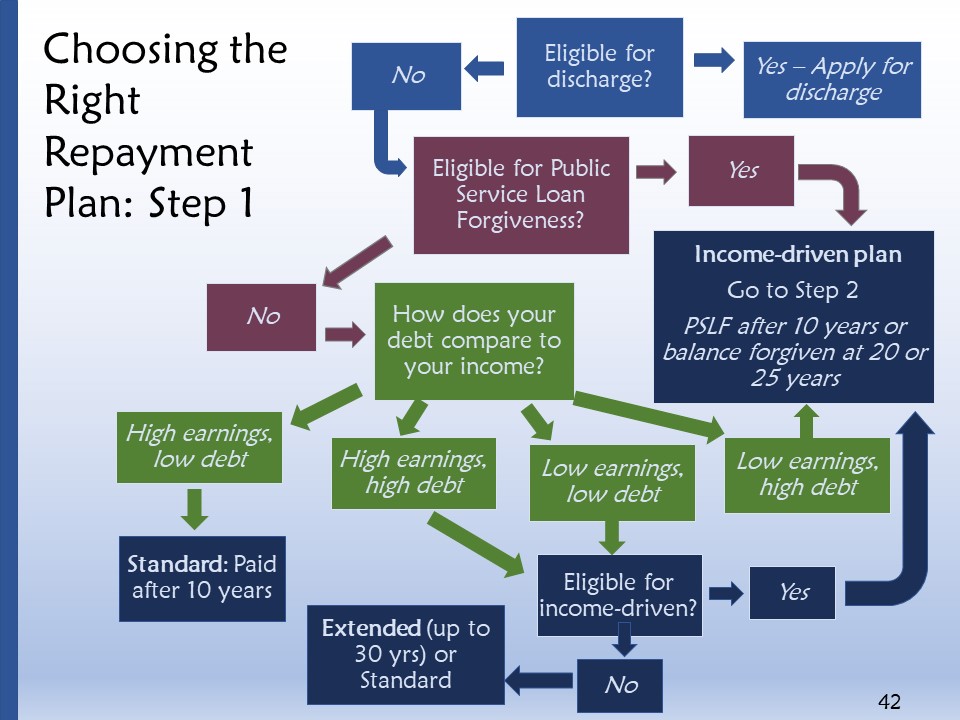

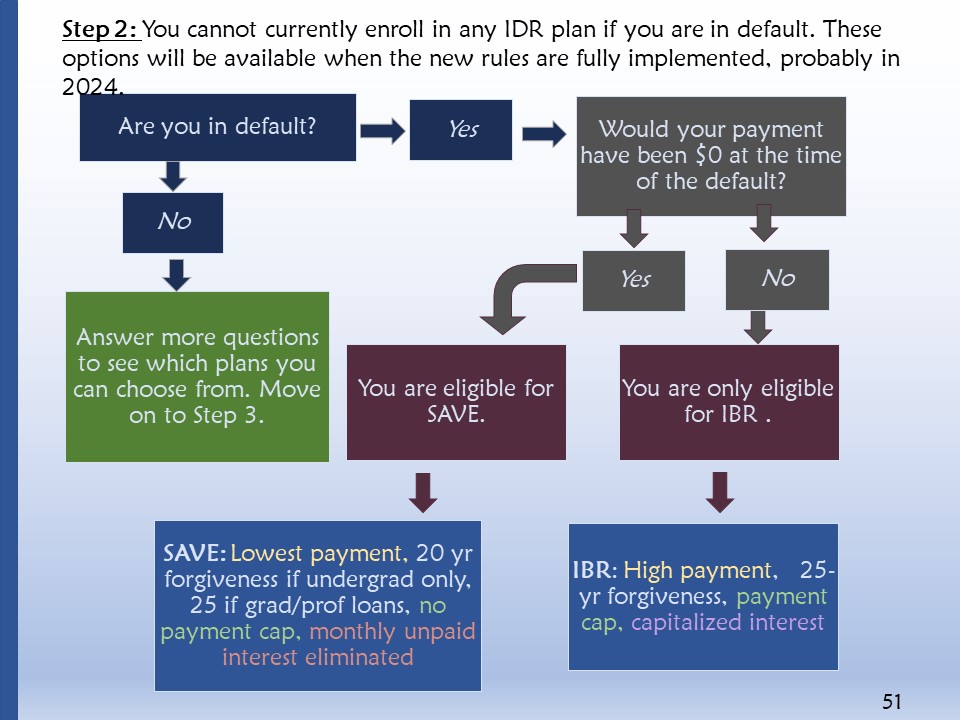

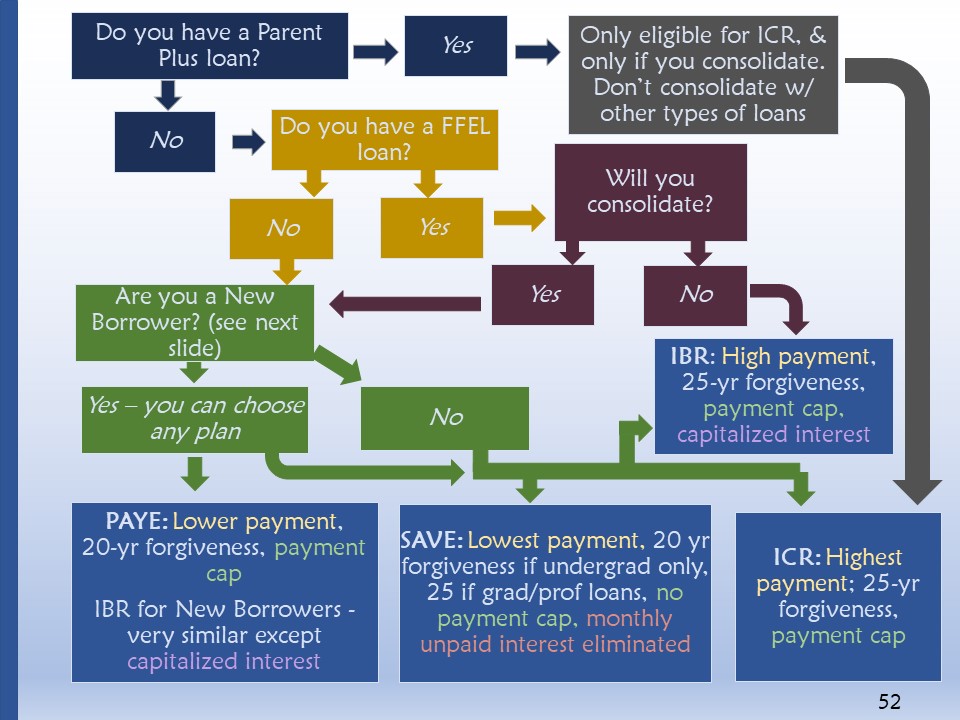

These three decision trees may help you get an idea of what repayment plan fits your situation. The first one looks at balance-driven plans versus income-driven plans as a group. The second one show you your options if you loan is in default. And the third helps you figure out which income-driven plan(s) you might be eligible for.

Step 1

Step 2

Step 3

Loan Consolidation

- Learn the pros and cons and other facts about Federal loan consolidation at https://studentaid.gov/manage-loans/consolidation.

Deferment and Forbearance

- You may get temporary relief when you’re unable to make your student loan payments by requesting a Deferment or a Forbearance: https://studentaid.gov/manage-loans/lower-payments/get-temporary-relief?_ga=2.44097380.1333762154.1673273079-926279928.1669147973

Difficulty making loan payments

- This graphic will point you to the options available, depending on your situation: https://studentaid.gov/sa/sites/default/files/trouble-paying-graphic.pdf

Loan forgiveness, discharge, and cancellation

- Get an overview of the different ways that student loans can be forgiven, discharged, or cancelled at https://studentaid.gov/manage-loans/forgiveness-cancellation

- For specifics about various programs, use these links:

- Public Service Loan Forgiveness https://studentaid.gov/manage-loans/forgiveness-cancellation/public-service

- Temporary Expanded Public Service Loan Forgiveness for loans that do not generally qualify https://studentaid.gov/manage-loans/forgiveness-cancellation/public-service/temporary-expanded-public-service-loan-forgiveness

- Teacher Loan Forgiveness program https://studentaid.gov/sa/repay-loans/forgiveness-cancellation/teacher

- Federal Perkins Loan Cancellation https://studentaid.gov/manage-loans/forgiveness-cancellation/perkins

- Public Service Loan Forgiveness https://studentaid.gov/manage-loans/forgiveness-cancellation/public-service