This site is being updated to focus on the assistance provided by the American Rescue Plan, the act that was signed into law on March 11, 2021. If a section has not yet been updated, that will be stated in the heading for that section.

This page is NOT a source for medical information about COVID-19 or the coronavirus. Please check the Centers for Disease Control and Prevention (CDC) or the World Health Organization (WHO) webpage for health-related information.

Click a topic to jump to that section of the page. Or, click PDF by the topic to download a fact sheet containing the same information.

About This List

Summaries of Assistance Provided by the American Rescue Plan PDF

Economic Impact Payments and Recovery Rebate Credits PDF

Unemployment Insurance PDF

Homeowners: Forbearance, Foreclosure, and Debt Forgiveness PDF

Renters

Credit Reports: Free Weekly Reports Through April 2022

Income Taxes

Filing Taxes Could Get You a Cash Refund PDF

Earned Income Tax Credit PDF

Child Tax Credit PDF

Tax Breaks for Child Care Expenses PDF

Help with Filing Your Taxes PDF

Student Loans – This link will take you to to the Student Loans page of this website, which has been updated with guidance about the end of the pandemic suspension and the Limited Time Waiver for Public Service Loan Forgiveness.

Existing Government Support Programs

About This List

This curated list contains sources that I have carefully evaluated for credibility and relevance as we deal with the financial fallout of the coronavirus. I have included official announcements from government entities, summaries and explanations of those government actions, and more general guidance about managing your personal finances during this unusual and stressful time. Where possible, I have used government and non-profit sources. But if I have found the most useful information on a commercial site with which I am familiar and that I trust, that is the link I will provide here.

I have spent the past 27 years providing research-based, non-commercial financial education, including nearly 20 years with University of Illinois Extension and the past 8 years through my own financial education LLC. To compile this list, I have used all that I have learned about selecting reputable sources of information. I hope you will find this list helpful.

I apologize in advance for any errors on this page. Although my goal is to be 100% accurate, that’s not likely to happen. That’s why I encourage you to visit the links I have provided rather than relying solely on my explanations. Back to top

Summaries of Assistance Provided by the American Rescue Plan

How the Massive New Stimulus Law Can Help You, Consumer Reports, March 24, 2021. https://www.consumerreports.org/business-economy/how-the-massive-new-stimulus-law-can-help-you/

$1.9 Trillion America Rescue Plan Contains Wide-Reaching Tax Changes, Iowa State University Center for Agricultural Law and Taxation, March 16, 2021. https://www.calt.iastate.edu/blogpost/19-trillion-america-rescue-plan-contains-wide-reaching-tax-changes

These sources are targeted to professionals such as attorneys and tax preparers, but they will also be helpful to individuals:

The American Rescue Plan Act Greatly Expands Benefits through the Tax Code in 2021, Tax Foundation, March 12, 2021. https://taxfoundation.org/american-rescue-plan-covid-relief/.

American Rescue Plan Act of 2021, JD Supra. This website is aimed at attorneys. On this page, you can search for in-depth articles by topic. https://www.jdsupra.com/topics/american-rescue-plan-act-of-2021/

FACT SHEET: The American Rescue Plan Will Deliver Immediate Economic Relief to Families, US Department of the Treasury, March 18, 2021. https://home.treasury.gov/news/featured-stories/fact-sheet-the-american-rescue-plan-will-deliver-immediate-economic-relief-to-families

American Rescue Plan Act passes with many tax components, Journal of Accountancy, March 10, 2021. https://www.journalofaccountancy.com/news/2021/mar/tax-components-coronavirus-relief-bill.html The Tax Provisions of the American Rescue Plan Act of 2021, Wolters Kluwer, March 17, 2021. https://www.wolterskluwer.com/en/expert-insights/wbot-tax-provisions-of-the-american-rescue-plan-act-of-2021

Economic Impact Payments and Recovery Rebate Credits

Payments will be made based on your adjusted gross income (AGI) as shown on your 2019 tax return, or on your 2018 return if you have not yet filed for 2019. Tip: Find your AGI on the 1040 form, line 8b for 2019 or line 8 for 2018.

| Filing status | Full payment if AGI below: | *No payment if AGI above: |

| Single, married filing separately | $75,000 | $99,000 |

| Head of household | $112,000 | $136,500 |

| Married filing jointly | $150,000 | $198,000 |

*Some sources say these limits only apply to households with no children or, for head of household, only 1 child.

The IRS has detailed information for each of the three Economic Impact Payments. The IRS is the source of most of the information included here about the payments and claiming the Recovery Rebate Credit on your tax return if you qualify for additional money. If your questions aren’t answered on this webpage, you will probably find the answers here:

- Payment #1 – CARES Act (Español)

- Payment #2 – Tax Relief Act of 2020 (Español)

- Payment #3 – American Rescue Plan (Español)

How to get your Economic Impact Payments, including any additional money for which you qualify

There have been three separate Economic Impact Payments since the beginning of the coronavirus pandemic. If you haven’t received all three payments, it’s not too late!

File your 2020 taxes to claim (Español):

There are several reasons you might qualify for more money from the Economic Impact Payments based on your 2020 return than you received based on your 2018 of 2019 tax returns. The same thing could happen next year when you file your 2021 taxes: you might qualify for more than you did based on your 2019 or 2020 tax return. For example:

Next year, if your 2021 tax return qualifies you for any additional money from the third Economic Impact Payment., you can claim it by filing your 2021 tax return. (See below for Reasons you might be eligible for more.)

The payments won’t cause other problems for you. If you have hesitated because of these concerns, don’t worry!

- no minimum income requirement.

- do not affect eligibility (See Question J2; (Español) for federal assistance or benefit programs. Exception: if you save the payment, after 12 months it could count as an asset.

- eport from Cornell University provides a detailed report about where you can verify that the payments will not impact many different types of benefits, including HUD rent subsidies, SSI, SNAP, and more. (Español)

- IRS Q&A Question J2) (Español)

- IRS Q & A Question J3) (Español)

- deadline for filing has been extended to May 17. And if you are getting a refund, you can file after May 17 without any penalty.

Who is eligible?

You are eligible to receive these payments (Español) if you meet these three criteria as well as the income limits shown in the table.

- You are a US citizen or US Resident Alien

- For married couples where only one spouse has a Social Security number, you can receive a partial payment.

- You have a Social Security number that is valid for employment

- You cannot be claimed as a dependent on someone else’s tax return.

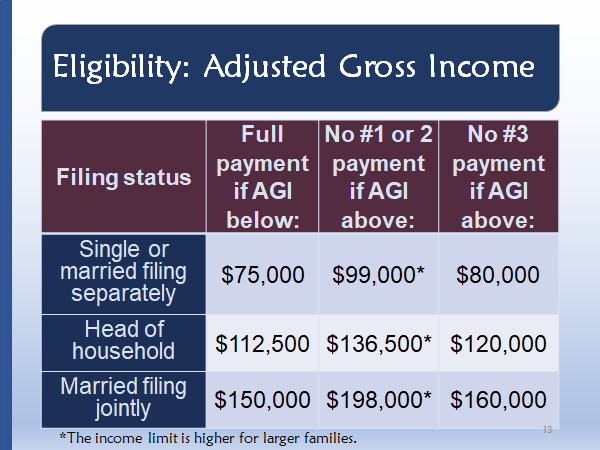

Payments are phased out for taxpayers above certain income limits. For Payments 1 and 2, the payment was reduced (phased out) by $5 for every $100 that your income exceeds the “Full Payment” amount in the table below. For those payments, the income at which payments fully phased out depended on the amount of the base (full) payment. For the third payment, the phaseout range is much smaller and the income at which payments stop is the same regardless of family size.

| Eligibility is based on Adjusted Gross Income (AGI) | |||

| Filing status: | Full payment if AGI below: | No #1 or 2 payment if AGI above: | No #3 payment if AGI above: |

| Single or married filing separately | $75,000 | $99,000* | $80,000 |

| Head of household | $112,500 | $136,500* | $120,000 |

| Married filing jointly | $150,000 | $198,000* | $160,000 |

| * The income limit is higher for larger families. A larger base payment amount resulted in a wider phaseout range. |

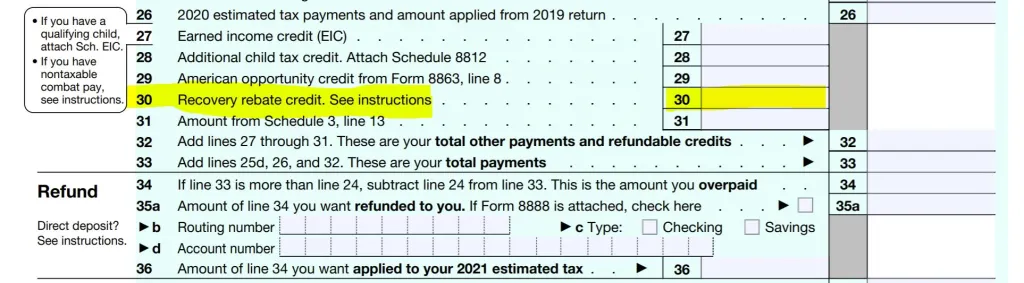

How to claim on your 2020 tax return

Claim additional money on Line 30 of the 1040 tax form (Español). It is called the Recovery Rebate Credit.

In the instructions for the 1040 (Español) see pages 56 and 57, and the worksheet on p. 58. The worksheet may look intimidating, but you can do it if you just follow the instructions line by line. Read and answer each step before you look at the next one.

Get Answers to Your Questions

Answers to most questions about the payments can be found on the IRS website.

- Questions about the 3rd payment, which started arriving in March 2021

- Eligibility, info for those who don’t usually file a tax return, what’s different compared to the first two payments, and links to additional information: https://www.irs.gov/coronavirus/third-economic-impact-payment

- Use the Get My Payment tool to find out the status of your payment. https://www.irs.gov/coronavirus/get-my-payment

- If you have questions about payment status, the address or bank account used to deliver your payment, using the Get My Payment tool, or other questions, check the Frequently Asked Questions (FAQs) .https://www.irs.gov/coronavirus/get-my-payment-frequently-asked-questions

- Questions about earlier payments

- Information about the first and second payments is no longer available through the Get My Payment tool. To see information about your individual payments, view or create your online account view or create your online account or look for the notices that were mailed to you following each payment, IRS Notices 1444 and 1444-B.

- 2nd payment https://www.irs.gov/coronavirus/second-eip-faqs

- Claiming missing payments or additional amounts for which you qualify with the Recovery Rebate Credit on your 2020 tax form https://www.irs.gov/newsroom/recovery-rebate-credit-frequently-asked-questions

Special Situations

For married couples where only one spouse has a Social Security number, you can receive a partial payment. See Question #1 and read to the end for updates. https://www.irs.gov/newsroom/questions-and-answers-about-the-first-economic-impact-payment-topic-a-eligibility

Incarcerated persons can now get payments – see Q7 https://www.irs.gov/newsroom/questions-and-answers-about-the-first-economic-impact-payment-topic-a-eligibility

Payments to deceased individuals: see Question #5, how to return payments sent in error, and claim payments for people who died during 2020 https://www.irs.gov/newsroom/questions-and-answers-about-the-first-economic-impact-payment-topic-a-eligibility

Comparing the Three Economic Impact Payments

| Economic Impact Payments | ||

| Source | Payments sent starting… | |

| Payment #1 | CARES Act | April 2020 |

| Payment #2 | Tax Relief Act of 2020 | December 2020 |

| Payment #3 2021 | American Rescue Plan | March 2021 |

Each program had a different payment amount. Only dependents under age 17 were eligible for the first two, but all dependents qualified for the third payment.

| Payment Amounts | |||

| Taxpayer (Filer) | Spouse | Dependents, per person | |

| Payment #1 | $1200 | $1200 | $500 if under age 17 |

| Payment #2 | $600 | $600 | $600 if under age 17 |

| Payment #3 2021 | $1400 | $1400 | $1400 for all dependents |

Payments were generated based on information from the most recent tax return that had been filed. The first and third payments began during the tax filing season. If the taxpayer had already filed that year, payments were based on the people, their ages, and income listed on that return. Otherwise, the information was based on the prior year’s return. For example, if a taxpayer had already filed her 2019 return before Payment #1 was calculated, that was used to calculate her payment. If she had not yet filed her 2019 return, the payments would have been based on the information on her 2018 return.

| Which year’s tax return is used? | |||

| Initial payment | Additional $, if any | If you didn’t receive the full amount: | |

| Payment #1 | 2018 or 2019 if already filed | 2020* | Final opportunity to claim or receive additional money compared to 2018 or 2019 is on your 2020 tax return. |

| Payment #2 | 2019 | 2020* | Same as Payment #1 |

| Payment #3 2021 | 2019 or 2020 if already filed | 2021* | File your 2020 tax return by 9/1/2021 to receive any additional payment compared to 2019. Final opportunity to claim is on your 2021 tax return. |

| * If you would have received less money based on this tax return than what you already received, you do not have to pay it back. |

Unemployment Insurance

Unemployment benefits are managed by each state individually. CareerOneStop.org provides links to each state’s unemployment information.

Beginning in March 2020, unemployment benefits cover more people, for a longer period of time, and with a larger benefit. Those “expansions” will be available until September 6, 2021. Even though these additional benefits are paid by the federal government, you still apply for unemployment through your state. Your payments will also come from your state.

Check the Illinois Department of Employment Security website for answers about eligibility, expanded benefits, and how to file for unemployment.

How are unemployment benefits expanded?

There are four ways that unemployment benefits have been expanded during the pandemic. The Illinois website uses the official names of these programs, so they are also listed here.

- Increases unemployment benefits by $300 per week until Sept. 6, 2021. This applies to anyone receiving unemployment benefits.

- The program is known as Federal Pandemic Unemployment Compensation (FPUC)

- Benefits can be paid for an additional 53 weeks beyond what states usually allow. That makes a total of 79 weeks of unemployment benefits in many states, including Illinois. The added weeks of benefits will end on April 6, 2021.

- This program is known as Pandemic Emergency Unemployment Compensation (PEUC).

- Coverage for unemployed people who don’t usually qualify for benefits has been extended to 73 weeks. This has also been extended for up to 73 weeks, ending April 6, 2021. This program covers people who lost work for a COVID-related reason but wouldn’t normally be eligible for unemployment benefits. This includes self-employed people, independent contractors, business owners, part time workers, and workers with a short work history.

- This is known as Pandemic Unemployment Assistance (PUA).

- If you are receiving unemployment benefits based on your work as an employee, but you also had self-employed income of more than $5000, you might qualify for an additional $100 per week.

- This is called Mixed Earners Unemployment Compensation (MEUC).

The Century Foundation has an excellent explanation of these programs and answers a long list of questions that you might have.

You won’t pay income tax on up to $10,200 of unemployment benefits in 2020.

For 2020, most people will pay no federal or Illinois income tax on the first $10,200 of benefits, or up to $20,400 if you are married filing jointly.

- If your income is above $150,000, your benefits will be taxed.

- If you received more than $10,200 of benefits, you will owe tax on the excess.

This rule only applies to benefits paid in 2020. If you receive benefits in 2021, expect to pay tax on that money. You can have taxes withheld from your benefits or pay estimated tax to avoid owing tax and perhaps a penalty when you file in 2022.

What to do if you filed early and paid taxes on unemployment

If you filed your taxes before the middle of March 2021, you probably paid tax on these benefits. The IRS will automatically refund that money to you, probably in May or June of 2021. You do not need to file an amended return unless the reduction in income makes you eligible for a credit that you did not already claim on your tax return.

If you filed your Illinois tax return before March 15, 2021, the state will make the adjustment and send you the refund. If you filed by mail or filed electronically after March 14, follow the instructions at https://www2.illinois.gov/rev/Pages/American-Rescue-Plan-Act-of-2021—Nontaxable-Unemployment-Benefits.aspx.

Homeowners: Forbearance, Foreclosure, and Debt Forgiveness

During the pandemic, mortgage payments can be suspended, foreclosures are delayed, and mortgage debt that is forgiven is not taxable.

Mortgage Forbearance

Forbearance suspends or reduces your payments for a certain amount of time. This will give you time to recover from hardship during the pandemic. It does not forgive any of the debt.

Learn more about forbearance on the Consumer Financial Protection Bureau webpage.

While your mortgage is in forbearance, your home is protected from foreclosure. Your lender cannot add any fees, penalties, or interest except what would have occurred if you made monthly payments.

You do not have to prove hardship, and credit history does not affect whether you can get forbearance.

If your mortgage is owned or backed by a federal government agency, it qualifies for forbearance. This includes most mortgages. Other mortgages may have different rules and programs. Federal government agencies that own or back mortgages include:

- U.S. Department of Housing and Urban Development (HUD)

- U. S. Department of Agriculture

- USDA Direct

- USDA Guaranteed

- Federal Housing Administration (FHA) (Includes reverse mortgages)

- U.S. Department of Veterans Affairs (VA)

- Fannie Mae

- Freddie Mac

Your payments typically go to a company that services your mortgage, not who owns the mortgage. The Consumer Financial Protection Bureau has tips to help you figure out who owns your mortgage.

Contact your mortgage servicer to request forbearance. Look on your monthly statement for the name and contact info for your mortgage servicer.

You must request forbearance; it is not automatic. If you are having difficulty paying your mortgage or other bills because of the pandemic, act quickly to get the forbearance started.

An initial forbearance can be up to 180 days. Before that ends, you can request an extension of up to 180 days. Certain lenders may offer two additional extensions of 3 months each.

There may be a deadline for requests forbearance. For HUD/FHA, USDA or VA mortgages, your forbearance must start by June 30, 2021. As of April 1, Fannie Mae or Freddie Mac had not announced a deadline.

Are your insurance and property taxes paid as part of your monthly payment? Ask how those will be handled during the forbearance. Insurance and taxes must be paid even if the mortgage is in forbearance, so find out how to make sure that happens.

Also ask how you will make up the missed payments when the forbearance ends. For example, will you need to make larger payments for a certain period of time? Can you add the payments on to the end of your mortgage, so that you will pay it off later? You should not have to make a very large payment when the forbearance ends.

There are no costs to get forbearance. If someone wants you to pay for help you, it could be a scam. Don’t work with anyone who wants money to get you a forbearance.

You can stop the forbearance at any time.

Foreclosure

Most homeowners are protected from foreclosure until June, 30, 2021. Foreclosure is when the lender takes your home when you haven’t made the payments.

If your mortgage is backed by a Federal agency, your lender or loan servicer cannot foreclose on you until after June 30, 2021.

If you’re having difficulty making your payments, you should request a forbearance which is explained in the previous section. If that isn’t possible, you can learn about other options in a booklet called Homeowner’s Guide to Success.

Mortgage Debt Forgiveness

Forgiveness of debt is usually considered taxable income. But from 2007 to 2025, forgiveness of debt on your personal home may not be taxable.

You might have debt forgiveness if

- You sell your home for less than you owe in a “short sale.” The lender forgives the difference.

- Your home is sold in foreclosure for less than what you owed.

- The lender agrees to a loan modification that reduces the balance that you owe.

Discharge of Qualified Personal Residence Indebtednessis the technical phrase for this. You can learn more at NOLO.com, a site that provides answers about legal problems. Also read the What’s New section and the section about Qualified Personal Residence Indebtedness in IRS Publication 4681.

Housing Counselors

A housing counselor approved by HUD can give you advice about foreclosure, mortgages, and other housing questions. There may be a small cost.

Renters

The March 2021 American Rescue Act included funding for rental assistance, but each locality has to get set up to provide that assistance. As a result, some programs may not be taking applications yet. Other programs will stop accepting applications very soon.

Here is the status as of April 6, 2021 for programs serving Chicago and Cook County:

- The Rental Assistance Program from the Chicago Department of Family & Support Services is accepting applications until April 16, 2021. After the deadline, they will use a lottery to select who will receive assistance. Everyone who applies will have an equal chance. You can apply online or by calling or visiting a Community Service Center. To see if you are eligible , to apply, or to find a Community Center near you, go to https://www.chicago.gov/city/en/depts/fss/provdrs/serv/svcs/how_to_find_rentalassistanceinchicago.html (Español)

- You can also use the Chicago Housing Assistance Portal to search for an assistance program that fits your situation. Answer a few questions about your income and living situation at https://www.chicago.gov/city/en/sites/affordable-housing-programs/home.html. For Spanish and other languages, click “Select Language” at the top of the page and select your language.

- Suburban Cook County renters can apply for help with rent and utilities from the Emergency Rental Assistance Program. They are only accepting applications until April 9, 2021. https://www.cookcountyil.gov/service/covid-19-recovery-emergency-rental-assistance-program

- The 2021 Illinois Rental Payment Program serves the entire state. It will probably start accepting applications later in April or May. You can still check the webpage to see if you will be eligible for this program and to see when the program re-opens. https://www.ihda.org/about-ihda/illinois-rental-payment-program/ For Spanish, click English at the top of the page and select Spanish.

Evictions

Evictions in Illinois were stopped until April 3, 2021. New guidance from the CDC (Centers for Disease Control) recommended that evictions be prohibited until June 30, 2021. As of April 6, we do not know whether Illinois will follow that recommendation. You can find legal forms and other kinds of legal assistance at https://www.illinoislegalaid.org/get-legal-help (Español) and other housing issues during the pandemic at https://www.illinoislegalaid.org/legal-information/housing-coronavirus-and-law (Español).

Credit Reports: Free Weekly Reports Through April 2022

The three major credit reporting agencies – Equifax, Experian, Transunion – are offering free weekly credit reports through April 2022. These free credit reports can be accessed only online, on the same website where you request your free annual credit reports: https://www.annualcreditreport.com/. Use these free reports to make sure that mortgages and student loans in forbearance, and other debts for which you received an accommodation are properly being reported as current., as explained in my blog post.

Income Taxes

Filing Taxes Could Get You a Cash Refund from Credits

Filing taxes could qualify you for credits that could give you a substantial refund, in addition to any money you still need to claim for the Economic Impact Payments. Even if you don’t usually file your taxes, you should consider filing taxes for 2020 and 2021. Changes in the rules make many credits more valuable than ever. And if your income dropped, you may be eligible for credits that you couldn’t claim before.

If you owe tax, tax credits will help pay your income taxes. If the credit is refundable and the credit is more than the tax you owe, you will get a refund for the difference. The Earned Income Tax Credit has always been refundable. For 2021, both the Child Tax Credit and the Child & Dependent Care Credit are also refundable. Filing your 2021 taxes next year could get you a very large refund.

You can claim more than one credit, as long as you are eligible for each one. For example, you might qualify for the Earned Income Tax Credit, the Child Tax Credit, and the Child & Dependent Care Credit. See the sections below for details about the various Credits available.

The deadline for filing your 2020 taxes is May 17, 2021. However, if you are getting a refund, there is no penalty for filing late.

If you could have received refunds in 2018 and 2019, you can still file to claim them. The deadline for filing and getting a refund for 2018 taxes is April 15, 2022 and April 15, 2023 for 2019 taxes. Fewer credits were refundable in 2018 and 2019, so you might not get a refund for those years even if you get one for 2020. On the other hand, there could be a lot of money at stake; it’s worth checking into.

Insight: If you are due a refund, you should file as soon as possible.

Earned Income Tax Credit

The Earned Income Tax Credit (Español) is a refundable credit is for working adults with limited incomes who:

- Have earned income.

- Have little or no investment income.

- Have a valid Social Security number.

- Were a US citizen or resident alien for the entire year.

- File taxes as Single, Married Filing Jointly, Head of Household, or Qualifying Widow/Widower.

- You cannot get the credit if you file as Married Filing Jointly.

Whether you qualify for the Earned Income Credit – and how much you receive – is based on your income. Learn more about who qualifies here (Español))The income limits for 2020 are shown in the following table. You can also check the income limits for other years (Español) to see if you qualified for 2019 or 2018. If so, you could still file to claim it.

| Earned Income Tax Credit for 2020 | |||

| Children or relatives claimed | Income limit for single, head of household or widowed | Income limit for married filing jointly | Income limit for single, head of household or widowed |

| None | $15,820 | $21,710 | $538 |

| 1 | $41,756 | $47,646 | $3584 |

| 2 | $47,440 | $53,330 | $5920 |

| 3 or more | $50,594 | $56,844 | $6660 |

| Income means Adjusted Gross Income (AGI) from line 10-C on the 1040 form. |

New Rules

For 2020 and 2021: There is a temporary rule may help you qualify for a larger credit if your income has changed. If your 2019 income was higher than 2020 or 2021, you can use 2019 income to receive a larger credit.

For 2021 only, the age restrictions for childless people to receive the credit have been changed. The youngest age for a childless person to receive the credit is lowered from 25 to 19. But childless, full time students between 19 and 24 are still not eligible. There is no upper age limit for the credit this year. And, childless persons can receive up to $1502, so their credit may be substantially larger than in 2020.

There is a permanent change starting in 2021, regarding the income limitations. The amount of investment income that is allowed is increased from $3650 to $10,000.

Not sure if you qualify?

Use the EITC Assistant to be sure. Go to https://www.irs.gov/credits-deductions/individuals/earned-income-tax-credit/use-the-eitc-assistant (Español).

Child Tax Credit

Changes made by the American Rescue Plan to the Child Tax Credit apply to 2021 only. During this year, more people will be eligible and the credit for most people will be larger than in other years. Thorough explanations were published by Kiplinger.com, which includes extensive FAQs and a calculator to figure out how much your credit might be, and by CNBC.

Key changes for 2021 are:

- The maximum amount of the credit increased. Instead of $2000 per child, the credit in 2021 is $3600 for each child younger than age 6 and $3000 for children 6 to 17. Previously, children had to be 16 or younger.

- Earned income is not required. Previously, you had to earn at least $2500 to qualify. Kiplinger said the earned income was only to get any part of the credit as a refundable credit.

- The entire credit is refundable.

- Parents can get half of the credit in the form of a monthly payment from July to December 2021. The remainder will be claimed on the family’s 2021 tax return.

The additional, 2021-only amount of the credit (either $1600 or $1000 depending on the age of the child) is reduced for people with higher incomes, beginning at:

- $75,000 for single filers

- $112,500 for head of household

- $150,000 for married filing jointly.

The permanent amount of the credit ($2000 per child) begins to phase out at $400,000 for married filing jointly and $200,000 for others.

Other requirements have not changed. The child must:

- Be a US citizen, national or resident alien.

- Have a Social Security number.

- Be claimed as a dependent on your tax return, and the return must include the child’s name, date of birth, and Social Security number.

- Be related to you, and must live with you for at least six months during the year.

As of April 1, 2021, the IRS webpage on this topic had not been updated with detailed information about the 2021 changes for this credit.

Tax Breaks for Child Care Expenses: Child & Dependent Care Credit and the Dependent Care Flexible Spending Account

Families paying for child care can choose from two ways to reduce their income taxes.

- Claim the Child & Dependent Care Credit when you file your income taxes.

- Have money deducted from your paycheck for a Dependent Care Flexible Spending Account.

You cannot count the same expenses for the Credit and for the Flexible Spending Account.

Child & Dependent Care Credit

The Child & Dependent Care Credit (Español)lets you claim a credit on your taxes for care of a child under age 13 that allowed you to work. Expenses such as day care, after school care, and summer day camp may qualify. You must provide either a Social Security or an Individual Taxpayer Identification Number (ITIN) for the care provider in order to claim the credit, unless the provider is a tax-exempt organization. The Credit is claimed by filing out Form 2441 and attaching it to your 1040 tax form (Español). Use the interactive assistant on the IRS website to determine whether or not you are eligible.

If you pay child care expenses, your credit could be substantially larger in 2021.

- The maximum credit is $4000 for the care of one person, or $8000 for two or more, compared to $1050 and $2100 for 2020.

- How is it calculated? For 2021, the credit is 50% of qualifying expenses of up to $8000 for care of one person and $16,000 for two or more. For 2020, it was 35% of up to $3000 of care expenses for one child and up to $6000 for two or more.

- The credit is fully refundable for 2021. In 2020, it was not refundable, meaning that It could reduce the tax you owed, but it would not increase the amount of your refund.

- The credit is reduced for taxpayers earning over $125,000. Taxpayers with incomes up to $400,000 will get gradually smaller credits. In previous years, the credit was reduced when your income exceeded just $15,000.

There are a lot of details associated with this credit. For more information, check out IRS Publication 503, Child and Dependent Care Expenses. This publication is updated each year. As of April 1, 2021, it had not been updated with the 2021 changes.

Flexible Spending Accounts

Flexible Spending Accounts let employees reduce their taxes by having money for certain expenses deducted from their paychecks without paying tax on it. The money is deposited into an account used specifically to pay for either child care, medical expenses, or commuter expenses that year. Employers choose whether to offer Flexible Spending Accounts, and some employers only offer one or two types.

The employer must sign up each year during open enrollment. You agree to have a certain amount deducted from each paycheck for the entire year. That part of your income avoids all taxes: federal and state income taxes, Social Security and Medicare taxes. The savings can be significant, especially for higher income earners.

You must use the money to pay eligible expenses during the year. Money left at the end of the year may be lost.

- For 2021:

- Higher limits for contributions to Dependent Care Flexible Spending Accounts. The limit increased from limit increased from $5000 to $10,500 for employees whose tax filing status is single or married jointly, and from $2500 to $5250 for married filing separately.

- However, each employer decides whether to allow the increased contributions.

- May be paid monthly beginning summer 2021

- Higher limits for contributions to Dependent Care Flexible Spending Accounts. The limit increased from limit increased from $5000 to $10,500 for employees whose tax filing status is single or married jointly, and from $2500 to $5250 for married filing separately.

- For 2020 and 2021: With limited exceptions, you lose any money left in a Flexible Spending Account at the end of the year. But for 2020 and 2021, you can roll over any unused money to use the next year.

Choose Flexible Spending Account or Child & Dependent Care Credit

If you use a flexible spending account to pay for care expenses, you cannot use the same expenses to claim the Child & Dependent Care Credit. You should compare the tax benefits to see which one is better for you.

Help with Filing Your Taxes: File for Free and Look for Free Tax Preparation Assistance

Do your own taxes for free, using software to guide you.

Many people hire someone to file their taxes. But you can do it yourself! That doesn’t mean you have to read through pages and pages of instructions in order to fill out confusing, complicated forms. You can access free versions of software that will guide you through the process of filing out the forms. And then you will be able to file your taxes for free.

To find software that will guide you through the process, and file for free.

- Income limit: $72,000 https://apps.irs.gov/app/freeFile/browse-all-offers

- No income limit: https://www.myfreetaxes.com/ Choose “By Myself” to use the software and do your taxes yourself. Click “With Assistance” to see if there are services that still have opening to do your taxes for you.

Get your taxes done for free.

Every year, there are many free tax preparation services available. But the pandemic has made it harder for these groups to serve people. Also, free tax preparation services may be full or already be closed for doing 2020 taxes.

Check these sources to look for free tax preparation services:

- https://irs.treasury.gov/freetaxprep/

- https://www.myfreetaxes.com/ provided by United Way

- For Chicago: http://www.taxprepchicago.org/ a partnership between the City of Chicago and Ladder Up, a non-profit organization.

File prior year taxes to get refunds you missed.

Did you miss getting credits such as the Earned Income Tax Credit, Child Tax Credit, or Child & Dependent Care Credit in 2018, or 2019? You can file 2018 taxes until April 15, 2022, and file 2019 taxes until April 15, 2023. There is no penalty for late filing if you are owed a refund. Ask free tax prep sites whether they prepare prior year returns. Otherwise, you may have to fill out the forms yourself or pay a tax preparer.

Student Loans

For complete, updated student loan information, including the end of the pandemic forbearance and the Limited-Time Waiver for Public Service Loan Forgiveness, see Student Loan section under the Resources tab.

The official government website for student loans, studentaid.gov, has established a dedicated page with extensive FAQs on all aspects of this relief.

If you have a qualifying loan, your payments will automatically be suspended (put into forbearance) with no interest and no late fees from March 13, 2020 through December 31, 2020. The original end-date set by the CARES Act (September 30, 2020) was extended by executive order by President Trump.

- Log in StudentAid.gov/login using FSA ID to access your StudentAid.gov dashboard

- Click on “view details” to go to Aid Summary.

- Scroll down to “Loan Breakdown.”

- If you see a servicer name that starts with “DEPT OF ED,” that loan that is owned by ED.

Any loans not listed here are generally private loans.

The law requires that borrowers with qualifying loans be notified within 15 days of the law’s enactment of the suspension and their option to continue making payments. You will also be notified prior to the end of the suspension.

Existing Government Support Programs

There are several permanent government assistance programs that will continue to serve people during the coronavirus pandemic. Details of some of these programs may differ by state, but https://www.usa.gov/help-with-bills will help you navigate to the right place for any of these programs in your state. If you live in Illinois, click the “Illinois” links for information or to apply.

- Gas or electric bills for heating and cooling: The Low Income Home Energy Assistance Program (LIHEAP) helps low income households may provide assistance. Eligibility requirements may vary by state.

- Medical bills: You might qualify for Medicaid and CHIP (for children).

- Prescription drug costs.

- Telephone service: The Lifeline Program from the Federal Communications Commission (FCC) provides discounts on landline or cell phone service for low income individuals.

- General assistance: Temporary Assistance for Needy Families (TANF) program provides temporary financial assistance for pregnant women and families with one or more dependent children. TANF provides financial assistance to help pay for food, shelter, utilities, and expenses other than medical.

- Illinois

- United States – all: Search for contact info for your state

- Food assistance:

- SNAP (Supplemental Nutrition Assistance Program) was formerly known as Food Stamps. It provides money for low income individuals and families to use to buy food. The money is deposited onto a card, like a debit card, that you use to buy groceries. You must apply locally.

- Illinois – info

- Illinois – application

- Use the national directory to find contact info for your state.

- WIC is a food assistance program for women, infants, and children, designed make sure that pregnant women, new mothers, and young children can access the food they need to stay healthy. To apply, you will need to visit a local agency in your state.

- Illinois – info

- Use the nationwide pre-screening tool to see whether you may be eligible; allow 15 minutes to complete it.

- SNAP (Supplemental Nutrition Assistance Program) was formerly known as Food Stamps. It provides money for low income individuals and families to use to buy food. The money is deposited onto a card, like a debit card, that you use to buy groceries. You must apply locally.

Yay, Karen!

Thx Karen. Be safe

Still have a little $ in market (don’t need for 5 yrs)

Sold all Bond mutual

Your prospective is always appreciated in these crazy days

I see u at Wilmette or Evanston

Thank you for taking the time to share these tools!

You are welcome!